Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. Follow the voting instructions in the Notice to ensure that your vote is counted. To vote online during the Annual Meeting, you must follow the instructions from your broker, bank, or other agent.

Internet voting during the Annual Meeting and/or Internet proxy voting in advance of the Annual Meeting allows you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your vote instructions. Please be aware that you must bear any costs associated with your Internet access.

Can I vote my shares by filling out and returning the Notice?

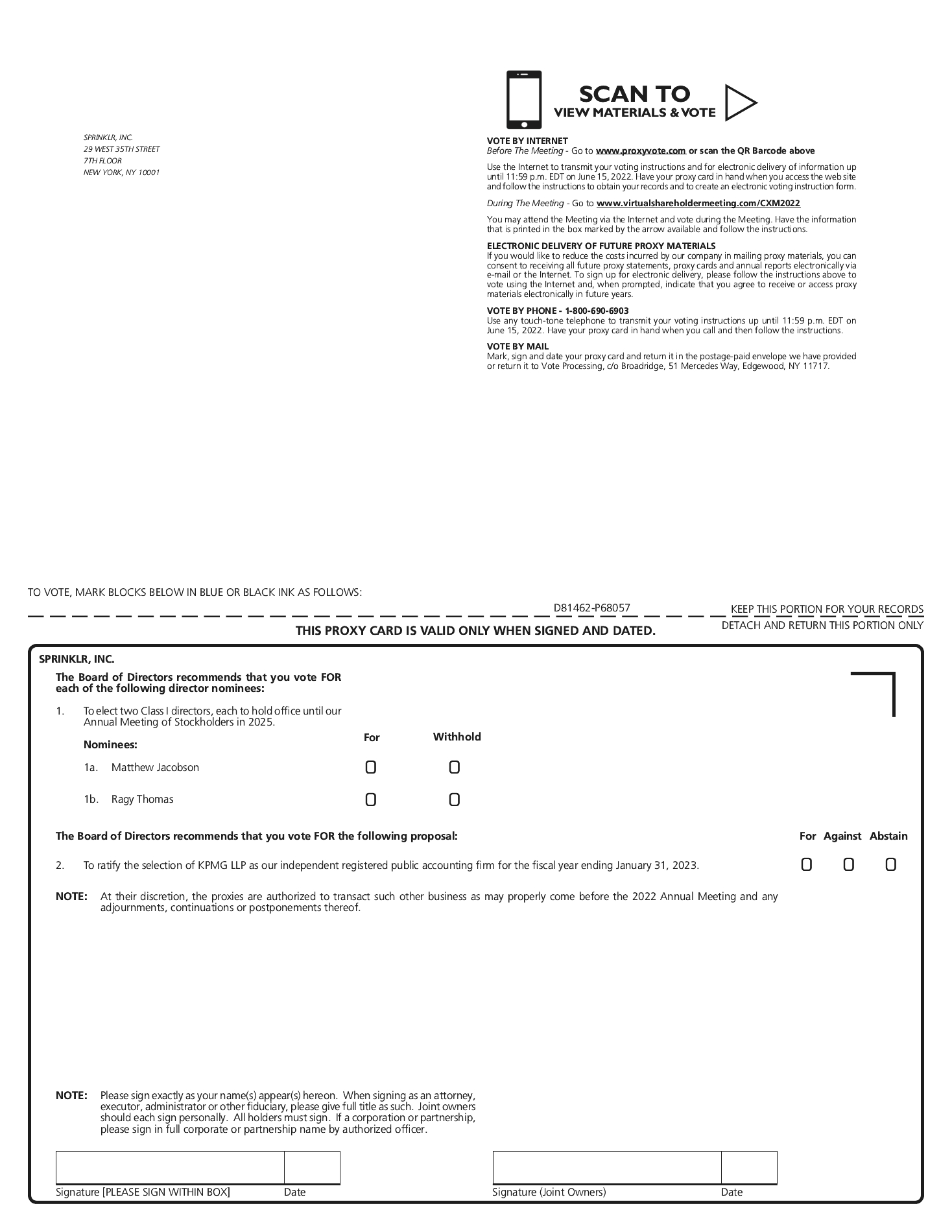

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by proxy in advance of the Annual Meeting through the Internet, by telephone, using a printed proxy card or vote instruction form, or online during the Annual Meeting.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote through the Internet, by telephone, by completing the proxy card that may be delivered to you or online during the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted in accordance with the recommendations of our board of directors: “FOR” the election of each of the two nominees for director and “FOR” the ratification of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2023. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

If I am a beneficial owner of shares held in “street name” and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner and do not instruct your broker, bank or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether, pursuant to stock exchange rules, the particular proposal is deemed to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation, and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may vote your shares on Proposal 2. Your broker or nominee, however, may not vote your shares on Proposal 1 without your instructions. Such an event would result in a “broker non-vote” and these shares will not be counted as having been voted on the applicable proposal. Please instruct your bank, broker or other agent to ensure that your vote will be counted.

If you a beneficial owner of shares held in street name and you do not plan to attend the Annual Meeting, in order to ensure that your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”